How SARS can 'pierce' the corporate veil to catch tax avoiders

News24

12 Jul 2019, 11:43 GMT+10

A relatively unknown piece of legislation could be an ace up the sleeve of the South African Revenue Service as it tries to catch shareholders who hide behind a company to avoid paying their taxes, according to a new study conducted at Stellenbosch University.

The study was done by Dr Albertus Marais as part of his doctoral thesis in Mercantile Law.

Piercing the corporate veil doesn't mean that the company's existence is being cancelled, but rather that its existence is ignored for a specific enquiry only, for instance the determination of tax consequences.

10 tax trends SARS is clamping down on

Marais notes that shareholders may use the corporate veil to avoid taxes by transferring shares held by an individual or a trust to a company of which the individual or trust is a shareholder.

In this way, dividend tax of the underlying share portfolio is avoided, since South African companies, as shareholders, are typically exempt from dividend tax on dividends declared to them.

"For income tax purposes in particular it may be beneficial for individuals to involve companies or layered company structures in transactions due to the beneficial regimes that the Income Tax Act affords companies," says Marais.

Creating awareness

He adds that it is important to create awareness about the potential application of Section 20(9), because the Income Tax Act's broad and powerful general anti-avoidance rules do little to address this problem.

"Tax avoidance is a distinctly grey area and the line between permissible and impermissible avoidance is far from clear," says Marais.

"Hopefully this study will contribute to making that distinction slightly clearer, especially where tax planning through the use of companies is involved."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Zimbabwe Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Zimbabwe Star.

More InformationInternational

SectionSources: Meta won’t alter data model, faces fresh EU charges

BRUSSELS, Belgium: Meta is holding firm on its controversial pay-or-consent model, a move that could lead to fresh antitrust charges...

Trump’s tariff push could push US rates above 20%, ICC says

LONDON, U.K.: American consumers and businesses could soon face the highest overall tariff burden in more than a century, according...

U.S. Urged to Investigate After Israeli Settlers Beat Palestinian-American to Death

The family of Sayfollah Saif Musallet, a 20-year-old American citizen who was beaten to death by Israeli settlers in the occupied West...

New Hampshire federal court ruling defies Trump’s citizenship move

CONCORD, New Hampshire: A federal judge in New Hampshire issued a crucial ruling on July 10 against President Donald Trump's executive...

Houthis attack cargo ship in Red Sea, raising maritime safety fears

DUBAI, U.A.E.: A cargo ship flagged under Liberia, known as the Eternity C, sank in the Red Sea following an attack executed by Yemen's...

Trump administration restarts Ukraine arms deliveries

WASHINGTON, D.C.: The Trump administration has started sending some weapons to Ukraine again, just a week after the Pentagon told officials...

Africa

SectionUAE: CM Mohan Yadav attends 'Madhya Pradesh Business Investment Forum' Program

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Dr Mohan Yadav attended the 'Madhya Pradesh Business Investment Forum Program'...

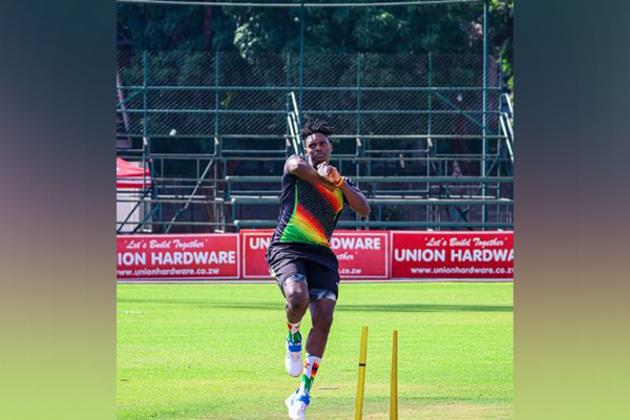

Richard Ngarava surpasses Sikandar Raza to become highest wicket-taker in T20Is for Zimbabwe

Harare [Zimbabwe], July 14 (ANI): Zimbabwe left-arm seamer Richard Ngarava became the top wicket taker for his national team in the...

Logistics, supply chain infrastructure, foreign investment feature as key avenues of discussion during MP CM Yadav's UAE visit

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Dr Mohan Yadav held wideranging interactions with industry experts for bringing...

South Africa's Lungi Ngidi levels iconic Dale Steyn's T20I record

Harare [Zimbabwe], July 14 (ANI): Known for his pace and crafty bowling, South Africa's Lungi Ngidi levelled legendary tearaway Dale...

Brevis, Linde shine as South Africa start tri-nation series with win over Zimbabwe

Harare [Zimbabwe], July 14 (ANI): A fantastic three-wicket spell by all-rounder George Linde and a fiery knock from Dewald Brevis helped...

PM Modi condoles demise of former Nigeria President Muhammadu Buhari

New Delhi [India], July 14 (ANI): Prime Minister Narendra Modi on Monday condoled the demise of former President of Nigeria, Muhammadu...